Note: Some of the links below are affiliate links which helps cover our costs and keeps SurveyPolice operational. Full affiliate disclosure here. Thank you for your support!

Claim all income and prizes

All income generated by taking online surveys should be reported on your income taxes. Keep check stubs on file and keep track of any PayPal payments you receive, in case of an audit. As well, you should also be claiming the cash value of gift certificates and other prizes you receive.

Although you might not have to pay taxes on your earnings and prizes from online surveys, it is in your best interest to report them to the IRS. If you must pay tax on your survey earnings, your marginal tax rate will depend on your income and tax-filing classification. All US citizens of the age of majority, are required to file income taxes, and upon doing your taxes, you will learn how much (if any) tax you will pay on your tax return.

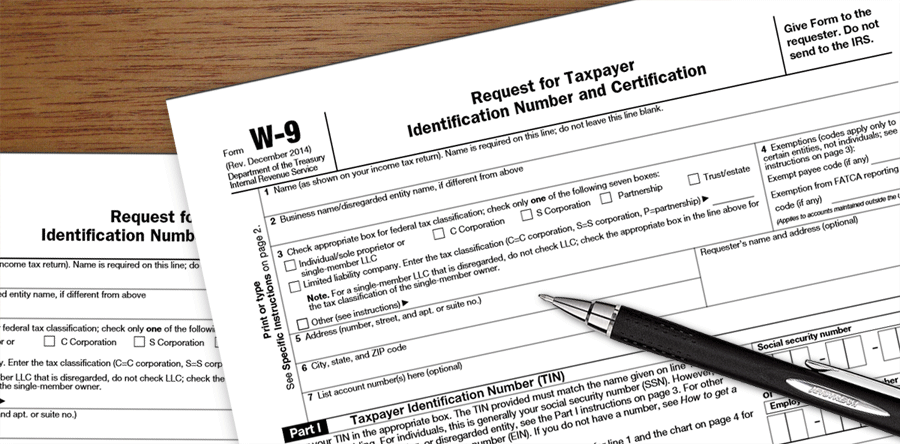

Filling out W9s

U.S. law requires market research companies based in the U.S. to report any amount over $600.00 paid to an individual over a single calendar year, to the IRS. If you reach this threshold, the research company will send you a form called a W9, whose information will be sent to the IRS. The form will ask you for your personally identifiable information (full name, address, etc.) as well as your SSN. This is strictly for tax purposes only and is the only time when it is acceptable to provide a research company with your social security number.

Read our full guide on W9’s and online survey taking if you’d like to learn more.

Where to report survey taking income

On your tax return (form 1040), there will be a line (currently, line 21) entitled “Other income”. Use this line to report the sum total of your earnings from survey taking. This line is used to report a variety of sources of income such as include winnings from lotteries, scholarships, rebates, etc. Online surveys income falls under the subcategories, ‘Non-employee Compensation’ and/or ‘Rewards’ and can be included here. However, if you filled out a W9, it may be best to use Schedule C.

» Calculate your estimated tax refund

Filling out a 1099-MISC

Instead of a W9 form, you may receive a 1099-MISC form if you’ve earned more than $600 a year from any individual survey company. Just like a W9, you will be asked to provide your full name and address. You will also need to supply your TIN (tax payer identification number).

If your overall income is very low

If your overall income falls below the personal exemption threshold of approximately $10,000 (including both the standard and personal deduction for an individual filing), it’s likely that you won’t owe anything to the IRS after filing your return. This threshold accounts for ALL income you’ve received for the year including employment income, income from surveys, etc. Whether you owe money to the IRS or not however, you must still file a tax return.

***Disclaimer: The information on this web page is not meant to substitute the advice from a professional. Please consult an accountant or other professional advisor to assist you in best using the information presented here. ***

» Find the top rated survey sites

Hello, I wanted to ask which box I should check on line 3 of the W-9. I do surveys as my only source of income, but I don’t know which category that puts me under.

What I need to know is paying tax for surveys with Swagbucks while on disability. I’m one gift card away from hitting the $600 threshold. Now I’m on disability and get $1005 a month. If I have to claim The $600+ from Swagbucks will I be paying taxes or can I now file and possibly get a refund using tax credits? Will I lose my disability because I made money doing surveys? I already don’t make enough to have any extra money to pay the IRS. This is why i do surveys so that I can get gift card to get any extras that i need. Thank you for taking the time to respond. I’m very worried.

Hi Mark,

Regardless of your tax situation, you should be filing a tax return with the IRS, as it is mandatory for all adults living in the USA.

While we don’t know the full details of your tax situation, remember that taxes work on a tiered system; you’ll never pay more tax on the first $10,000 you make, regardless of your income level. So for example, if you made $20,000 total in one year (including disability payments and income from surveys), the first $10,000 would be taxed the same as if you made a total of $10,000 for the entire year.

Taking surveys online should also not impact your eligibility for disability. Taking surveys is not a job in the true sense of the word, and as earnings can vary wildly, it should have no affect on your disability payments.

Thank you for your input. I found it to be a valuable bit of information.

I redeemed a small amount of money only 5 dollars but I found out that income from online surveys requires you to file taxes over $600. I am only 16 and is a dependent so should I be concerned about it or no because it is not necessary to file taxes at my age.

Hi Shay,

You will only be sent a form to fill out if you make over $600 a year from the same survey site. So if you’ve taken surveys from different sites for small amounts like $5 here and there, you won’t be sent any sort of tax forms to fill out.

You can find out more information in our online surveys for teens article.

Hi,

I’m a resident for tax purposes in US, and in August last year I moved to Canada and continued to get extra earnings from online survey websites as I did in US, and those earnings (with partially CAD now) have been deposited into my paypal account registered in US. I wonder how to determine which country I should report those income to. By the way, there are still some websites with my US address, and I’m not sure if it matters, but just in case. Thanks.

Hi HQ,

Although you’d have to consult a tax professional or accountant to be sure, our understanding of where to report income is dependent on where you were residing when you earned said income. So if you’re taking surveys in Canada while living there, you should be reporting that income earned to the CRA when you file your next tax return, even if technically you still have a registered address with some survey companies in the USA. Either way, a quick check with your accountant, tax pro, or even a free call to the IRS or the CRA just to be sure, is a good idea, as we aren’t 100% sure of this.

You should most definitely update your address with the survey panels you have accounts with. Virtually all survey companies use IP tracking software which will match user IPs to the country of residence listed in their account. If there is an anomaly like there would be for you, i.e. a US address using a Canadian IP address, you risk having your accounts suspended. Contact each company individually and let them know you’ve moved before updating your address officially – this will minimize the chance of problems down the road.

I have a serious question I am disabled so I receive disability ssdi but on the side for a few dollars I take surveys online surveys but they’re not above $600 since I don’t I don’t earn any money outside of the surveys that I do also I’m disabled and receiving disability but I don’t have a job I am unable to work a job because of my physical disability do you think they would come after me for not filing

Hi Zachary,

Sorry to hear about your situation. It’s important to file your taxes, as you are unlikely to owe anything to the IRS and could potentially be missing out on credits, etc.

In terms of not claiming your survey earnings on your taxes, the onus is ultimately on you. If you’re in a very low tax bracket, it’s unlikely that your earnings will be taxed much anyway, if even at all, so even for peace of mind, it’s better to claim any earnings than not.

Hello,

I have been taking online surveys and will be filing them under schedule C. with the 1099-MISC. My question is I am able to get some deductions if I list expenses such as internet and phone bills that are accrued while taking the survey. Am I able to list these expenses or is that only if personally own a part of the business?

Thanks so much,

Jessica

I did surveys for freester. There was money earned from the companies and fees involved. i was told to subtract the 2 and that is the money earned. How do I do this on the tax forms?

Hi Monica,

We’re not sure what you mean by ‘subtract the 2’…you’ll have to contact freester directly and ask them to clarify the amount.

What if you just earn points but no money from online surveys, do you still have to pay taxes?

Hi Cass,

Presumably, the points you earn from taking surveys would represent a cash value. So when you actually exchange your points for a cash payment or a gift card, you will be able to assign a monetary value to your points. This is the amount you should be claiming on your income tax return.

I have been doing surveys for one company and have gone over the$600 mark. I do not have any other income coming in. My question is will the survey company send me something in the mail so I can file my tax or is it all up to me to figure out how to get this done? And how much roughly would the taxes owed amount be?

Hi Matthew,

The survey company you’ve earned more than $600 with will send you a W9 form to complete.

The survey company won’t send you anything else in terms helping you file your taxes. Taxes need to be filed by every US taxpayer, regardless of their income. To declare your income from online survey taking, simply enter your earnings on to line 21, entitled ‘Other Income’.

We are not accountants, so we cannot estimate how much your taxes owed would be. However, if you have no other income for the year, other than a few hundred dollars from surveys, you will likely fall below the personal exemption amount, which means it’s unlikely you will owe anything to the IRS. Even so, you must still file a tax return.

I’ve reached 500 or more and they’ve said I have to file taxes but they never sent me a form to fill out so I’m confused on what I have to do next. How much would I have to pay? And how could I file this?

I got a 1099Misc, and from what I saw online, that is not line 21 but line 16 because they checked box 7. This is costing me over an extra $100 because they didn’t put it in box 3, which is line 21… what a waste of time doing those surveys, I am out a total of $253 by doing them.

for tax purposes when do survey companies start the new year? if you stop earning to stay below the 600 threshold when do survey companies allow you to start cashing out again does it start on jan 1 of the new year or is it later?

Hi Mark,

Survey companies consider January 1st to be the start of the new year. Redemptions that happen after this date should be considered part of that year’s earnings. In some cases, companies may instead use the date of when a survey was completed to calculate what year the earnings belong to, but this is atypical. So if you redeem your earnings on January 2, 2017 for surveys that were completed in 2016, your redemption should count towards 2017’s total earnings.

Taking online surveys is currently my only source of income. I’ve made about $550 this year. I am a single adult, under 65. Is it really worth it to the government that I file taxes? After I take the standard deduction they would owe me a lot of money. Would they disallow the standard deduction?

Hi JM,

It is our understanding that every US citizen who is not listed as a dependent is required by law to file taxes. As we are not tax advisors, we are unsure how to answer your question regarding the standard deduction, however, if your income level is very low, your total income tax may likely be $0. For more information, you may wish to consult the IRS Withholding Calculator to run a simulation of your tax scenario.

Similar question to what JM asked. If I reach or go over $400 in survey earnings in a year, I imagine the tax I owe would be pretty high, right? If that’s the case, it seems like completing surveys online might not be worth it. I don’t want to accidentally go over $400. I heard surveys only pay you preferably around a dollar or two. There’s no you could afford the tax making that much money without having a decent job.

Hi C.,

Thank you for your question. If you make more than $600 in any given calendar year through the same market research company, they will request that you complete a W9 form. This form will then be kept on file by the market research company who will then pass on this information to the IRS. If you make less than $600 year taking surveys from different companies, or even the same one, you will not be required to complete this form.

The tax rates are dependent upon your level of total income. If you fall into a low income bracket for instance, and you claim your survey earnings, the taxes owed will still be relatively low. It’s only if you’re already a high income earner and are at one of the top marginal tax rates, will additional claimed income from surveys be taxed heavily.

To find some of the best survey sites out there, take a look at our top user rated survey sites.